Appingine

Let's Discuss Your Tech Solutions

There have been multiple instances where you've heard the word “FinTech”. But what does this word mean? Fintech is another name of financial technology, which manages everything related to finance, from mobile banking to peer-to-peer and AI-powered advisors. It's not just about managing finances online, but it manages multiple transactions; most of all, it saves you the time that you would have spent hours waiting in the bank.

As of today, the banking requirements have changed. Nowadays, banks can only survive the competition by having good service-providing platforms. If you are an entrepreneur, then it is a fruitful time to invest in Fintech app development, because It's not about providing services online, anymore, but meeting customers' expectations is the newest trend in the banking sector.

There was a time when the fintech industry faced backlash, but now is the time when it has experienced a discernible comeback. According to the market statistics, it is predicted that the market will expand by 16.8% per year between 2024 and 2032 while reaching an incredible value of over

Fintech digital technologies, including app solutions and other platforms that help make money management and financial transactions easier for consumers and organizations, & they are in high demand. In fact, 78% of people under 40 stated that they would only stick with their traditional bank if it completely switched to digital. 2026 is an excellent year to start developing your first fintech app since investors and customers are visibly interested.

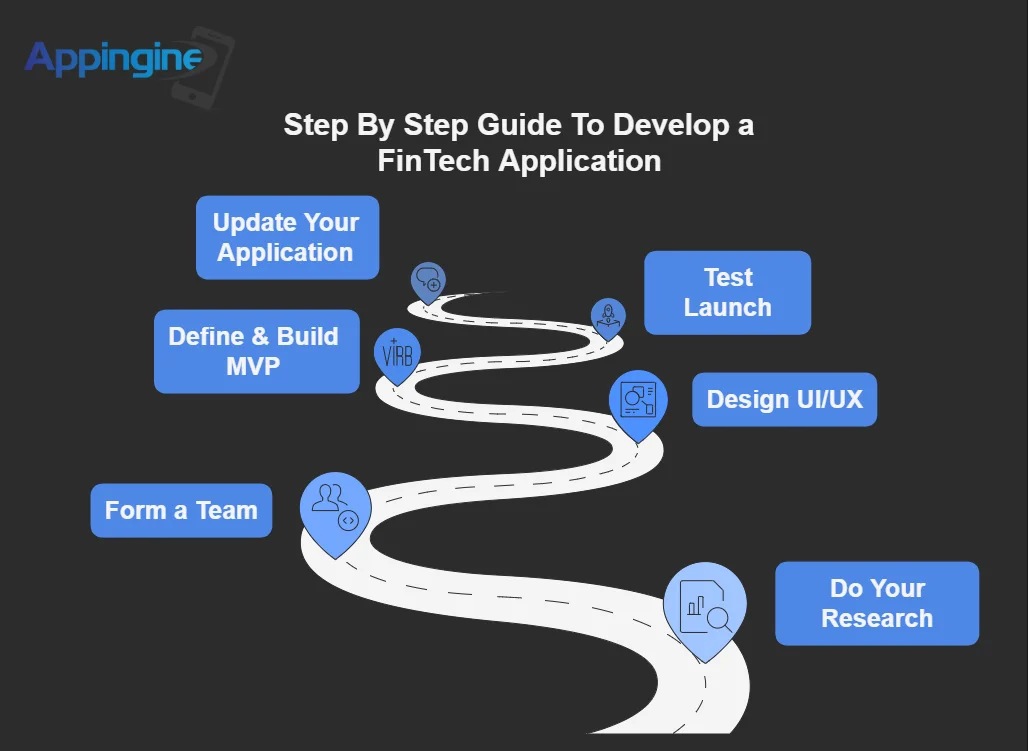

Here are detailed guided steps on how to make a FinTech mobile app:

Before they begin the process of fintech app development, software developers have to do a lot of research by going through the ongoing market trends and gathering your business requirements. Then, a clear map is outlined to finalize the list of features and functionalities that should be integrated into your fintech application.

It is vital to have a group of professionals by your side to build an exceptional fintech mobile application. When you step into the process of development, you can either outsource the project or hire an in-house team. Ensure to convey the goals and vision of the fintech app development, so each member should be familiar with the basic working of the app. To have a quality product that drives maximum conversion rate and brings success to your doorstep, you will need experienced people in the following niches:

While working on the layout of the mobile application, it is necessary to choose vibrant colors, be it a clean and tidy layout with user-friendly functions. But keep in mind, all necessary features should be available on the dashboard without the user having to go to the time-consuming search.

In this stage of the fintech development, a clear scope of your MVP app (Minimum Viable Product) is defined. It can be done by going through the following steps.

Launching the application takes a few steps, which include launching the beta version of the application so your consumers have access at your workplace. When all the issues and problems have been resolved and are ready to be released in the market.

In the world of fintech, there are always new features and elements that are incomparable and exciting at the same time. With the evolution of technology, you have to update your finished application regularly.

Get expert guidance with a proven development roadmap and a tech stack designed for compliance and scale.

Discuss Your FinTech ProjectTechstack isn’t just a set of tools that are used to develop a fintech app, but choosing the right tech stack that aligns with your business needs is a plus point. Let's have a look at the advanced tools and technologies that can be the best fit according to your finance business.

One of the greatest combinations for finance web applications is undoubtedly React and Node.js. Just consider the volume of real-time data that finance apps must handle. Since the backend is carefully managed by Node.js, this is not a problem. React is a perfect fit for the timely updation of the financial data on the frontend without requiring a refresh.

You'll probably have to decide between native and cross-platform development because finance apps tend to favor mobile technologies. Some of the most popular iOS and Android frameworks for developing native financial mobile apps are Kotlin and Swift, if you choose to go native these apps are more expensive due to some top-notch advantages such as the ability to operate offline. For every platform, a separate codebase is kept.

A better option is provided by cross-platform apps, which reduce development time and expenses while enabling you to create and manage a single codebase that functions flawlessly on several platforms, including iOS and Android. Although technologies like Xamarin, React Native, and Flutter are frequently used for cross-platform development, many teams prefer React Native due to its effectiveness and possible cost savings of up to 50% because Xamarin and Flutter are typically more expensive to build and maintain. Developers use reliable software development tools for teamwork, version control, and project management in addition to your fundamental frameworks or programming languages.

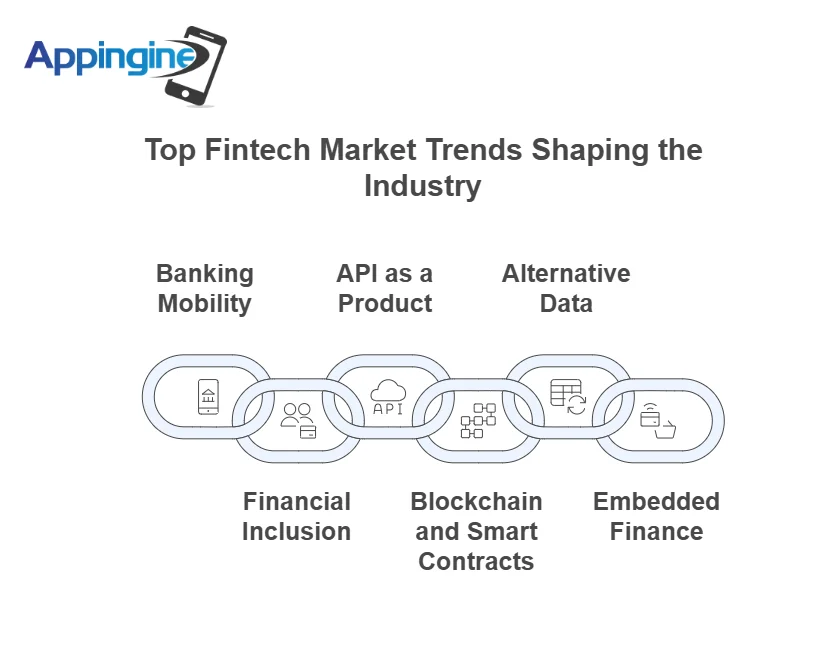

When you work on the development of a fintech application, it is necessary to have a clear understanding of the features and functionalities that will take your app to market successfully. Let's have a clear picture of the ongoing trends.

Banks are feeling the strain from fintechs and are increasingly relying on smartphone and web apps to deliver key services on the go. The epidemic has hastened this tendency, with neobanks challenging the status quo of in-person banking.

Financial technology is helping underprivileged people, minorities, and people of all ages have access to more inclusive services. For example “SilverTech”, a company that only services seniors and helps them manage their healthcare expenditures and retirement plans.

Along with allowing connectivity and integration throughout the financial management platforms and Open Banking is a driving force. APIs are now becoming a useful product that firms like Plaid, Galileo, and Marqueta monetize.

Blockchain has removed many of the hurdles to financial transactions which includes authorization from intermediaries such as banks. Using blockchain, smart contracts allow for the secure and transparent exchange and storage of data.

Fintechs are enriching their client data with alternative data such as social media activity or wearable devices, allowing previously ineligible customers to get access to financial services. Big Data management is a big challenge for fintechs due to the volume of information collected.

Embedded finance refers to the integration of financial services such as bill payment, insurance, and loans into non-financial systems. Embedded finance services are especially useful for e-commerce platforms since they provide a seamless customer experience without leaving the app.

With our experienced developers, we help you reduce risk, control costs and accelerate time-to-market.

Build Your FinTech AppHere is a list of FinTech mobile app types that you can choose from when developing your own:

You should thoroughly evaluate your target audience, the category your fintech app fits under, and how they will use it before developing it. Let's take a closer look at some of the more common varieties.

Many of the cumbersome procedures and red tape associated with applying for various kinds of coverage, from life insurance to property and pet insurance, are eliminated by insurtech apps. Users may purchase insurance policies, submit claims, and receive immediate customer care assistance using these fintech apps. InsureTech systems use the Internet of Things (IoT) and AI-powered analytics to better assess risk and provide individualized insurance plans based on a person's risk profile and lifestyle.

Traditional financial institutions are known to be disliked by millennials because it is predicted that today's generation is more likely to have the maximum growth in terms of personal wealth. And with the help of these applications, money management is becoming a piece of cake. By taking advantage of these platforms, users may better understand their spending patterns, make appropriate plans, receive tax guidance and manage their money.

Investment applications are becoming more popular, much like personal finance. An increasing number of people are trying to find a different source of income because over 80% of millennials say they do not anticipate being able to retire. For those with little prior knowledge, investment apps provide a simple and cost-effective way to build and maintain investment portfolios, get expert advice, or use robo-advisors to automate investment decisions.

Peer-to-peer lending apps give small enterprises and individuals new methods to apply for loans directly from other users. They have more appealing options, such as borrowing smaller sums of money that they can repay interest-free, rather than taking out bank loans and incurring exorbitant interest rates.

The entire process of utilizing virtual currency in daily life is made easier by these programs. Cryptocurrency apps are similar to other fintech apps in many aspects; however, they employ cryptocurrency coins rather than cash. For instance, you can exchange ordinary money for cryptocurrency via an exchange app or you can store coins in your cryptocurrency wallet exactly like you would in a standard digital wallet. To ensure you're properly handling these financial aspects, it's crucial to take into account how an app manages taxes on cryptocurrency transactions.

Not to get confused about the utilization of the latest technology and tools, we have gathered some details about the best examples for the fintech applications that are ruling the fintech industry on a next level.

By taking advantage of the fintech mobile app development, assisting with every transaction is traceable, while checking in and checking out is never easier than ever before.

Not only for the established businesses, but small businesses are able to leverage streamlined services by cutting transaction costs, surcharge fees, hiring staff to monitor every single transaction, and more. By taking advantage of these services, businesses can save a lot of money and effort.

Numerous financial apps, from tiny but powerful MVPs to Open Banking solutions that access data from banks around Europe, have been developed and released by our Appingine team. Fintech app development usually costs anywhere from $30,000 to $350,000 on average. For this reason, you should take into account the following factors to gain a better understanding of estimations and budget:

As a top mobile app development company, Appingine's team advises starting with a basic version of the application that has just the right number of components to test your idea on the market if you're just starting in fintech development.

In 2026, creating a fintech application requires more than just utilizing digital technology but it also requires creating secure, user-centered solutions that adapt to shifting customer needs and market trends. The success of your product depends on every decision you make, from understanding financial concepts and market expansion to choosing the best app type, tech stack and development technique.

Whether you're developing a digital banking app, investment platform or payment solution while concentrating on scalability, compliance, a smooth user experience and continuous enhancements will help you stand out in a highly competitive market & build a loyal user-base.

Let’s create a high-performance fintech app without compromising on the quality that delivers seamless UX, strong security and real business impact.

Let’s Get StartedThe development timeline for a fintech app usually ranges from 3 to 9 months, which depends on app complexity, features, compliance requirements and whether you’re building an MVP or a full-scale solution.

Yes, fintech apps can be highly secure when built correctly. Security is ensured through data encryption, secure APIs, multi-factor authentication (MFA), biometric login, tokenization, secure cloud infrastructure, and compliance with regulations like PCI-DSS, GDPR, SOC 2, and AML/KYC standards.

Fintech apps must comply with regional and global regulations such as:

Many compliances depend on the app type and the target market.

The cost of fintech app development typically ranges from $30,000 to $350,000. The final budget depends on:

Starting with an MVP is often the most cost-effective approach.

An MVP (Minimum Viable Product) is a basic version of your fintech app that includes only essential features. It helps validate your idea, attract early users, reduce risk, gather feedback, and optimize costs before investing in full-scale development.